Uncover The Investment Secrets Of Jonathan Berkery: Mergers, Acquisitions, And Financial Expertise Revealed

Jonathan Berkery is an American entrepreneur and investor. He is the founder and CEO of Berkery Noyes, a global investment bank specializing in mergers and acquisitions, private equity, and financial advisory services.

Berkery Noyes has a team of over 100 professionals in 12 offices around the world. The firm has completed over 1,000 transactions with a total value of over $100 billion. Berkery Noyes has been recognized as a leading investment bank by various publications, including The Wall Street Journal, Forbes, and Mergermarket.

Berkery is a graduate of the University of Pennsylvania's Wharton School. He is a member of the Young Presidents' Organization and the World Economic Forum. He is also a board member of the National Venture Capital Association and the National Association of Investment Bankers.

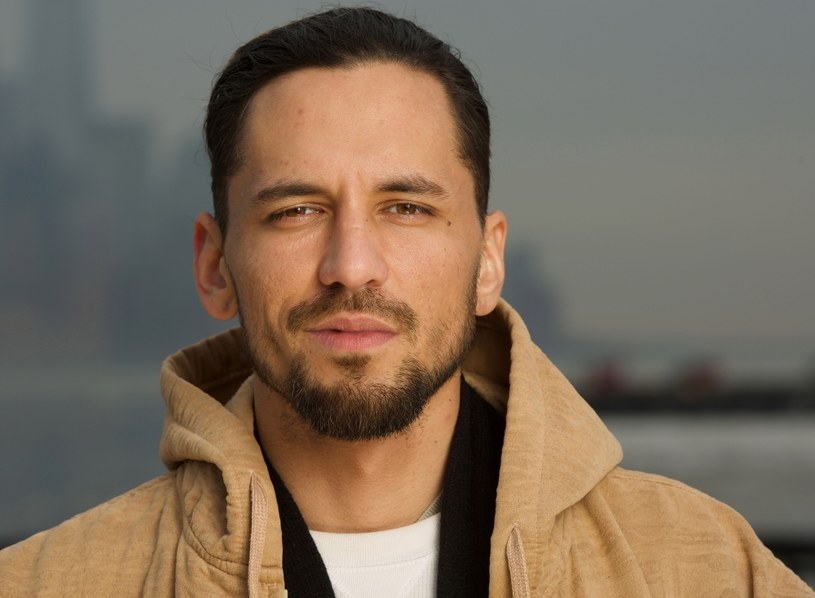

Jonathan Berkery

Jonathan Berkery is an American entrepreneur and investor. He is the founder and CEO of Berkery Noyes, a global investment bank specializing in mergers and acquisitions, private equity, and financial advisory services.

- Entrepreneur

- Investor

- Mergers and acquisitions

- Private equity

- Financial advisory services

- Global reach

- Experienced team

- Successful track record

Berkery Noyes has a team of over 100 professionals in 12 offices around the world. The firm has completed over 1,000 transactions with a total value of over $100 billion. Berkery Noyes has been recognized as a leading investment bank by various publications, including The Wall Street Journal, Forbes, and Mergermarket.

Berkery is a graduate of the University of Pennsylvania's Wharton School. He is a member of the Young Presidents' Organization and the World Economic Forum. He is also a board member of the National Venture Capital Association and the National Association of Investment Bankers.

| Name | Jonathan Berkery |

| Occupation | Entrepreneur, investor |

| Company | Berkery Noyes |

| Education | University of Pennsylvania's Wharton School |

| Memberships | Young Presidents' Organization, World Economic Forum, National Venture Capital Association, National Association of Investment Bankers |

Entrepreneur

An entrepreneur is an individual who creates a new business, bearing the risks and enjoying the rewards. Entrepreneurship is the process of designing, launching and running a new business, which is often initially a small business. The term is derived from the French word entreprendre, which means "to undertake."

Jonathan Berkery is an entrepreneur who founded Berkery Noyes, a global investment bank specializing in mergers and acquisitions, private equity, and financial advisory services. Berkery Noyes has a team of over 100 professionals in 12 offices around the world. The firm has completed over 1,000 transactions with a total value of over $100 billion.

Berkery's entrepreneurial spirit has led him to create a successful business that has helped many other businesses achieve their goals. He is a role model for other entrepreneurs who are looking to start and grow their own businesses.

Investor

An investor is a person or organization that provides capital to a business in exchange for a share of the profits. Investors can be individuals, such as venture capitalists or angel investors, or they can be institutions, such as banks or pension funds.

Jonathan Berkery is an investor who has founded and funded several successful businesses. He is the founder and CEO of Berkery Noyes, a global investment bank specializing in mergers and acquisitions, private equity, and financial advisory services. Berkery Noyes has a team of over 100 professionals in 12 offices around the world. The firm has completed over 1,000 transactions with a total value of over $100 billion.

Berkery's success as an investor is due to his ability to identify and invest in businesses with strong growth potential. He is also a skilled negotiator and has a deep understanding of the financial markets. Berkery is a role model for other investors who are looking to achieve success in the business world.

Mergers and acquisitions

Mergers and acquisitions (M&A) are transactions in which companies combine or acquire other companies to create a larger, more powerful entity. M&A can be used to achieve a variety of strategic objectives, such as increasing market share, expanding into new markets, or gaining access to new technologies or products.

- Acquisitions

Acquisitions occur when one company purchases all or a majority of the shares of another company, giving the acquiring company control over the acquired company. Acquisitions can be friendly, in which the acquired company's management and shareholders agree to the transaction, or hostile, in which the acquiring company makes an unsolicited offer to purchase the acquired company.

- Mergers

Mergers occur when two or more companies combine to form a new company. Mergers can be either horizontal, in which two companies in the same industry combine, or vertical, in which companies in different stages of the same supply chain combine.

- Joint ventures

Joint ventures are partnerships between two or more companies that are created to achieve a specific business objective. Joint ventures can be used to share costs, reduce risks, and gain access to new markets or technologies.

- Strategic alliances

Strategic alliances are agreements between two or more companies to cooperate on a specific project or venture. Strategic alliances can be used to share resources, reduce costs, and gain access to new markets or technologies.

Jonathan Berkery is an expert in mergers and acquisitions. He has advised on and executed numerous M&A transactions for a variety of clients, including Fortune 500 companies and private equity firms. Berkery Noyes, the investment bank that Berkery founded, has a team of over 100 professionals in 12 offices around the world. The firm has completed over 1,000 transactions with a total value of over $100 billion.

Private Equity

Private equity is a type of investment that involves the purchase of equity in privately held companies. Private equity firms typically invest in companies that are not publicly traded, and they often take an active role in managing the companies they invest in.

- Investment Strategy

Private equity firms typically invest in companies that they believe are undervalued and have the potential for growth. They often take an active role in managing the companies they invest in, providing strategic guidance and operational support.

- Types of Investments

Private equity firms can invest in a variety of different types of companies, including startups, middle-market companies, and distressed companies. They can also invest in a variety of different industries, including technology, healthcare, and manufacturing.

- Exit Strategies

Private equity firms typically exit their investments through an initial public offering (IPO), a sale to another company, or a recapitalization. The exit strategy will depend on a variety of factors, including the stage of the company's development and the market conditions.

- Returns

Private equity investments can generate high returns, but they also involve a high degree of risk. Private equity firms typically charge high fees, and there is no guarantee that an investment will be successful.

Jonathan Berkery is an expert in private equity. He has advised on and executed numerous private equity transactions for a variety of clients, including Fortune 500 companies and private equity firms. Berkery Noyes, the investment bank that Berkery founded, has a team of over 100 professionals in 12 offices around the world. The firm has completed over 1,000 transactions with a total value of over $100 billion.

Financial advisory services

Financial advisory services are provided by professionals who help individuals and organizations make informed financial decisions. These services can include investment advice, retirement planning, estate planning, and tax planning.

- Investment advice

Investment advice can help individuals and organizations make informed decisions about how to invest their money. This advice can include recommendations on which investments to buy or sell, as well as how to allocate assets across different asset classes. - Retirement planning

Retirement planning can help individuals and organizations prepare for their financial future. This planning can include setting retirement goals, choosing investments, and maximizing retirement savings. - Estate planning

Estate planning can help individuals and organizations ensure that their assets are distributed according to their wishes after they die. This planning can include creating a will, trust, and power of attorney. - Tax planning

Tax planning can help individuals and organizations minimize their tax liability. This planning can include maximizing deductions and credits, as well as choosing the right investments.

Jonathan Berkery is an expert in financial advisory services. He has advised on and executed numerous financial advisory transactions for a variety of clients, including Fortune 500 companies and private equity firms. Berkery Noyes, the investment bank that Berkery founded, has a team of over 100 professionals in 12 offices around the world. The firm has completed over 1,000 transactions with a total value of over $100 billion.

Global reach

Jonathan Berkery is a global investment banker with a reach that extends across the world. His firm, Berkery Noyes, has offices in 12 countries and has completed transactions in over 50 countries.

- International clients

Berkery Noyes has a diverse client base that includes companies from all over the world. The firm's global reach allows it to provide its clients with the expertise and resources they need to succeed in international markets.

- Cross-border transactions

Berkery Noyes has extensive experience in cross-border transactions. The firm's team of professionals understands the legal and regulatory complexities of doing business in different countries.

- Global network

Berkery Noyes has a global network of relationships with other investment banks, law firms, and accounting firms. This network allows the firm to provide its clients with access to the best possible resources and advice.

- Local expertise

Berkery Noyes has a team of professionals who are based in different countries around the world. This local expertise allows the firm to provide its clients with the insights and knowledge they need to make informed decisions about their international business operations.

Jonathan Berkery's global reach is a key differentiator for his firm. It allows Berkery Noyes to provide its clients with the expertise and resources they need to succeed in international markets.

Experienced team

Jonathan Berkery has assembled an experienced team of investment bankers at Berkery Noyes. The team has a deep understanding of the mergers and acquisitions, private equity, and financial advisory services industries. They have advised on and executed numerous transactions for a variety of clients, including Fortune 500 companies and private equity firms.

The experienced team at Berkery Noyes is a key differentiator for the firm. It allows Berkery Noyes to provide its clients with the expertise and resources they need to succeed in their transactions. The team's experience and knowledge of the industry helps to ensure that clients get the best possible advice and execution for their transactions.

For example, Berkery Noyes recently advised a Fortune 500 company on the sale of its non-core business unit. The team's experience in the industry helped to identify the right buyer for the business unit and negotiate a favorable price for the client. The transaction was completed successfully, and the client was very satisfied with the outcome.

The experienced team at Berkery Noyes is a valuable asset to the firm. The team's expertise and knowledge of the industry helps to ensure that clients get the best possible advice and execution for their transactions.

Successful track record

Jonathan Berkery has a successful track record in the investment banking industry. He has advised on and executed numerous mergers and acquisitions, private equity, and financial advisory transactions for a variety of clients, including Fortune 500 companies and private equity firms.

Berkery's successful track record is due to a number of factors, including his deep understanding of the industry, his experienced team, and his commitment to providing clients with the best possible advice and execution.

For example, Berkery Noyes recently advised a Fortune 500 company on the sale of its non-core business unit. The transaction was complex and required a high level of expertise and experience. Berkery Noyes was able to successfully navigate the transaction and achieve a favorable outcome for the client.

Berkery's successful track record is a valuable asset to his clients. It gives them confidence that they are working with a firm that has the expertise and experience to help them achieve their goals.

FAQs about Jonathan Berkery

Jonathan Berkery is an American entrepreneur and investor. He is the founder and CEO of Berkery Noyes, a global investment bank specializing in mergers and acquisitions, private equity, and financial advisory services.

Question 1: What is Jonathan Berkery's professional background?

Jonathan Berkery is an entrepreneur and investor with over 20 years of experience in the investment banking industry. He has advised on and executed numerous mergers and acquisitions, private equity, and financial advisory transactions for a variety of clients, including Fortune 500 companies and private equity firms.

Question 2: What is Berkery Noyes?

Berkery Noyes is a global investment bank specializing in mergers and acquisitions, private equity, and financial advisory services. The firm has a team of over 100 professionals in 12 offices around the world. Berkery Noyes has completed over 1,000 transactions with a total value of over $100 billion.

Question 3: What types of clients does Berkery Noyes serve?

Berkery Noyes serves a diverse client base that includes Fortune 500 companies, private equity firms, and middle-market companies. The firm has a global reach and has completed transactions in over 50 countries.

Question 4: What is Jonathan Berkery's role at Berkery Noyes?

Jonathan Berkery is the founder and CEO of Berkery Noyes. He is responsible for the overall strategic direction of the firm and its day-to-day operations.

Question 5: What are some of Jonathan Berkery's accomplishments?

Jonathan Berkery has been recognized as a leading investment banker by various publications, including The Wall Street Journal, Forbes, and Mergermarket. He is also a member of the Young Presidents' Organization and the World Economic Forum.

Question 6: What is Jonathan Berkery's investment philosophy?

Jonathan Berkery believes in investing in businesses with strong growth potential. He is also a skilled negotiator and has a deep understanding of the financial markets.

Summary

Jonathan Berkery is a successful entrepreneur and investor with a proven track record in the investment banking industry. He is the founder and CEO of Berkery Noyes, a global investment bank specializing in mergers and acquisitions, private equity, and financial advisory services.

Next

To learn more about Jonathan Berkery and Berkery Noyes, please visit the firm's website at www.berkerynoyes.com.

Tips from Jonathan Berkery

Jonathan Berkery is an American entrepreneur and investor. He is the founder and CEO of Berkery Noyes, a global investment bank specializing in mergers and acquisitions, private equity, and financial advisory services.

Tip 1: Do your research

Before making any investment, it is important to do your research and understand the company, the industry, and the market. This will help you to make informed decisions and avoid costly mistakes.

Tip 2: Be patient

Investing is a long-term game. It takes time to build wealth and achieve your financial goals. Don't expect to get rich quick. Be patient and disciplined with your investment strategy.

Tip 3: Diversify your portfolio

Don't put all your eggs in one basket. Diversify your portfolio by investing in a variety of different assets, such as stocks, bonds, and real estate. This will help to reduce your risk and improve your chances of achieving your financial goals.

Tip 4: Rebalance your portfolio regularly

As your investment portfolio grows, it is important to rebalance it regularly to ensure that your asset allocation remains aligned with your risk tolerance and financial goals.

Tip 5: Don't panic sell

When the market takes a downturn, it is important to stay calm and avoid panic selling. Market downturns are a normal part of the investment cycle. If you sell your investments when the market is down, you will lock in your losses. Instead, ride out the storm and wait for the market to recover.

By following these tips, you can improve your chances of achieving your financial goals. Investing is a complex and challenging endeavor, but it is also one of the most rewarding. By doing your research, being patient, diversifying your portfolio, rebalancing your portfolio regularly, and avoiding panic selling, you can set yourself up for success.

For more information on investing, please visit the Berkery Noyes website at www.berkerynoyes.com.

Conclusion

Jonathan Berkery is a successful entrepreneur and investor with a proven track record in the investment banking industry. He is the founder and CEO of Berkery Noyes, a global investment bank specializing in mergers and acquisitions, private equity, and financial advisory services.

Berkery's success is due to a number of factors, including his deep understanding of the industry, his experienced team, and his commitment to providing clients with the best possible advice and execution.

For more information on Jonathan Berkery and Berkery Noyes, please visit the firm's website at www.berkerynoyes.com.

Jonathan Berkery, syn Toma Jonesa, jest bezdomny. Mieszka w schronisku

Tom Jones son Star's love child Jonathan Berkery speaks out about