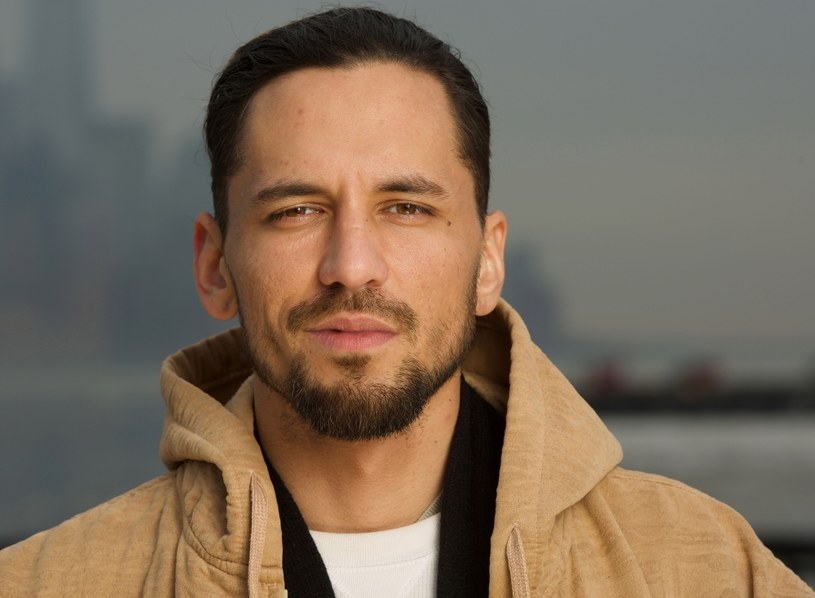

Unlock Financial Secrets With Johnathan Berkery

Johnathan Berkery is a financial advisor and the founder and CEO of Berkery Wealth Management, a wealth management firm that provides comprehensive financial planning services to individuals and families. He is a CERTIFIED FINANCIAL PLANNER professional and has over 15 years of experience in the financial services industry.

Berkery Wealth Management is a fee-only financial planning firm, which means that it does not receive any commissions from the sale of financial products. This allows Berkery Wealth Management to provide objective, unbiased advice to its clients. The firm's services include financial planning, investment management, retirement planning, and estate planning.

Berkery is a frequent speaker on financial planning topics and has been featured in a number of publications, including The Wall Street Journal, Forbes, and Bloomberg. He is also the author of the book "The Ultimate Guide to Financial Planning." Berkery is a member of the National Association of Personal Financial Advisors (NAPFA) and the Financial Planning Association (FPA).

Johnathan Berkery

Johnathan Berkery is a CERTIFIED FINANCIAL PLANNER professional and the founder and CEO of Berkery Wealth Management, a wealth management firm that provides comprehensive financial planning services to individuals and families. He has over 15 years of experience in the financial services industry.

- Financial advisor

- Founder and CEO

- CERTIFIED FINANCIAL PLANNER

- 15 years of experience

- Fee-only financial planning firm

- Objective, unbiased advice

- Financial planning

- Investment management

- Retirement planning

Berkery Wealth Management is a fee-only financial planning firm, which means that it does not receive any commissions from the sale of financial products. This allows Berkery Wealth Management to provide objective, unbiased advice to its clients. The firm's services include financial planning, investment management, retirement planning, and estate planning.

Berkery is a frequent speaker on financial planning topics and has been featured in a number of publications, including The Wall Street Journal, Forbes, and Bloomberg. He is also the author of the book "The Ultimate Guide to Financial Planning." Berkery is a member of the National Association of Personal Financial Advisors (NAPFA) and the Financial Planning Association (FPA).

| Name | Johnathan Berkery |

|---|---|

| Occupation | Financial advisor, founder and CEO of Berkery Wealth Management |

| Credentials | CERTIFIED FINANCIAL PLANNER |

| Experience | Over 15 years in the financial services industry |

| Memberships | National Association of Personal Financial Advisors (NAPFA), Financial Planning Association (FPA) |

Financial advisor

A financial advisor is a professional who provides financial advice and guidance to clients. Financial advisors can help clients with a variety of financial planning needs, including:

- Investment planning: Financial advisors can help clients develop and implement investment strategies that are designed to meet their individual financial goals. This may involve recommending specific investments, such as stocks, bonds, or mutual funds.

- Retirement planning: Financial advisors can help clients plan for retirement by estimating their retirement income needs and developing strategies to save for retirement. This may involve recommending specific retirement savings accounts, such as 401(k)s or IRAs.

- Education planning: Financial advisors can help clients plan for the cost of education. This may involve recommending specific education savings accounts, such as 529 plans.

- Estate planning: Financial advisors can help clients plan for the distribution of their assets after they die. This may involve recommending specific estate planning tools, such as wills and trusts.

Financial advisors can be a valuable resource for individuals and families who are looking to make informed financial decisions. Financial advisors can help clients achieve their financial goals by providing them with personalized advice and guidance.

Founder and CEO

Johnathan Berkery is the founder and CEO of Berkery Wealth Management, a wealth management firm that provides comprehensive financial planning services to individuals and families.

- Leadership and Vision

As the founder and CEO, Johnathan Berkery is responsible for the overall leadership and vision of Berkery Wealth Management. He sets the strategic direction of the firm and ensures that the firm's values are upheld.

- Client Relationships

Johnathan Berkery is actively involved in client relationships. He meets with clients to discuss their financial goals and objectives and develops personalized financial plans to help them achieve their goals.

- Team Management

Johnathan Berkery is responsible for managing the team of financial advisors at Berkery Wealth Management. He provides training and support to the team and ensures that they are providing the highest level of service to clients.

- Business Development

Johnathan Berkery is also responsible for business development for Berkery Wealth Management. He meets with potential clients to discuss the firm's services and how the firm can help them achieve their financial goals.

Johnathan Berkery's role as founder and CEO of Berkery Wealth Management is essential to the success of the firm. He is a visionary leader who is committed to providing the highest level of service to clients.

CERTIFIED FINANCIAL PLANNER

The CERTIFIED FINANCIAL PLANNER (CFP) certification is a professional credential for financial planners that is granted by the CFP Board. To earn the CFP certification, individuals must complete a rigorous education program, pass a comprehensive exam, and meet ongoing continuing education requirements. The CFP certification is recognized as the highest standard of professional competence in financial planning.

Johnathan Berkery is a CERTIFIED FINANCIAL PLANNER professional. This means that he has met the rigorous education, examination, and experience requirements of the CFP Board. As a CFP professional, Johnathan Berkery is committed to providing his clients with the highest level of financial planning services.

The CFP certification is important because it ensures that financial planners have the knowledge and skills to provide competent and ethical financial advice. CFP professionals are required to adhere to a code of ethics and are held to a fiduciary standard of care. This means that they are required to act in the best interests of their clients.

For individuals and families who are looking for a financial planner, it is important to choose a CFP professional. CFP professionals have the education, experience, and ethical commitment to provide the highest level of financial planning services.

15 years of experience

Johnathan Berkery has over 15 years of experience in the financial services industry. This experience has given him the knowledge and skills to provide comprehensive financial planning services to individuals and families.

- Financial planning

Johnathan Berkery has experience in all areas of financial planning, including investment planning, retirement planning, education planning, and estate planning. He can help clients develop and implement financial plans that are designed to meet their individual financial goals.

- Investment management

Johnathan Berkery has experience managing investment portfolios for individuals and families. He can help clients develop and implement investment strategies that are designed to meet their individual risk tolerance and return objectives.

- Retirement planning

Johnathan Berkery has experience helping clients plan for retirement. He can help clients estimate their retirement income needs and develop strategies to save for retirement. He can also help clients choose the right retirement accounts and investments.

- Education planning

Johnathan Berkery has experience helping clients plan for the cost of education. He can help clients choose the right education savings accounts and investments. He can also help clients develop strategies to reduce the cost of education.

Johnathan Berkery's 15 years of experience in the financial services industry makes him a valuable resource for individuals and families who are looking to make informed financial decisions.

Fee-only financial planning firm

A fee-only financial planning firm is a financial planning firm that does not receive any commissions from the sale of financial products. This means that fee-only financial planning firms are able to provide objective, unbiased advice to their clients. Johnathan Berkery is the founder and CEO of Berkery Wealth Management, a fee-only financial planning firm.

There are several benefits to using a fee-only financial planning firm. First, fee-only financial planning firms are not incentivized to sell clients financial products that may not be in their best interests. Second, fee-only financial planning firms are more likely to provide comprehensive financial advice, as they are not limited to recommending products from a specific company or set of companies. Third, fee-only financial planning firms are more likely to be transparent about their fees, as they do not receive any commissions from the sale of financial products.

For individuals and families who are looking for objective, unbiased financial advice, using a fee-only financial planning firm is a good option. Fee-only financial planning firms can help clients achieve their financial goals by providing them with personalized advice and guidance.

Objective, unbiased advice

Objective, unbiased advice is a cornerstone of Johnathan Berkery's approach to financial planning. As a fee-only financial advisor, Berkery is not beholden to any particular financial products or companies, which allows him to provide his clients with advice that is solely in their best interests.

- Independence

Berkery's fee-only status means that he is not influenced by commissions or sales quotas, which can bias the advice that financial advisors provide. This independence allows Berkery to provide objective advice that is tailored to his clients' individual needs and goals.

- Transparency

Berkery is transparent about his fees and the services he provides. This transparency helps clients to make informed decisions about whether to work with Berkery and how to structure their financial plan.

- Education

Berkery is committed to educating his clients about their financial options. He believes that clients should be empowered to make informed decisions about their finances. Berkery provides his clients with clear and concise explanations of complex financial concepts.

- Customization

Berkery's financial plans are customized to meet the individual needs of his clients. He takes the time to get to know his clients' financial goals, risk tolerance, and investment objectives. This allows him to develop financial plans that are designed to help his clients achieve their financial goals.

Johnathan Berkery's commitment to providing objective, unbiased advice is evident in all aspects of his financial planning practice. Berkery is a trusted advisor who can help his clients make informed financial decisions and achieve their financial goals.

Financial planning

Financial planning is the process of creating a roadmap for your financial future. It involves setting financial goals, creating a budget, and developing a strategy to achieve your goals. Financial planning is an ongoing process that should be reviewed and updated regularly as your life circumstances change.

- Investment planning

Investment planning is the process of developing a strategy to achieve your financial goals. This may involve investing in stocks, bonds, mutual funds, or other financial products. Investment planning should be based on your risk tolerance, time horizon, and financial goals.

- Retirement planning

Retirement planning is the process of saving and investing for retirement. This may involve contributing to a 401(k) or IRA. Retirement planning should be started as early as possible to maximize the power of compound interest.

- Education planning

Education planning is the process of saving and investing for your children's education. This may involve contributing to a 529 plan. Education planning should be started as early as possible to maximize the amount of money you can save.

- Estate planning

Estate planning is the process of planning for the distribution of your assets after your death. This may involve creating a will or trust. Estate planning can help to ensure that your wishes are carried out after you die.

Johnathan Berkery is a CERTIFIED FINANCIAL PLANNER professional with over 15 years of experience in the financial services industry. He can help you develop a comprehensive financial plan that meets your individual needs and goals.

Investment management

Investment management is the process of making and managing investment decisions with the goal of achieving specific financial objectives. Johnathan Berkery is an experienced investment manager who can help you develop and implement an investment strategy that meets your individual needs and goals.

- Asset allocation

Asset allocation is the process of dividing your investment portfolio into different asset classes, such as stocks, bonds, and cash. The goal of asset allocation is to create a portfolio that has the right mix of risk and return for your individual needs and goals.

- Security selection

Security selection is the process of selecting individual investments, such as stocks or bonds, for your portfolio. The goal of security selection is to choose investments that have the potential to generate the highest possible return for the level of risk you are willing to take.

- Portfolio management

Portfolio management is the process of managing your investment portfolio over time. This may involve making changes to your asset allocation or security selection, as well as rebalancing your portfolio to ensure that it remains aligned with your risk tolerance and investment goals.

Johnathan Berkery can help you with all aspects of investment management, from developing an investment strategy to managing your portfolio over time. He is a CERTIFIED FINANCIAL PLANNER professional with over 15 years of experience in the financial services industry. He can help you achieve your financial goals.

Retirement planning

Retirement planning is the process of saving and investing for retirement. It is an important part of financial planning, and it should be started as early as possible. There are many different ways to save for retirement, and the best approach will vary depending on your individual circumstances.

Johnathan Berkery is a CERTIFIED FINANCIAL PLANNER professional with over 15 years of experience in the financial services industry. He can help you develop a retirement plan that meets your individual needs and goals.There are many benefits to working with a financial planner when it comes to retirement planning. A financial planner can help you:- Determine how much money you need to save for retirement

- Choose the right retirement savings accounts

- Invest your retirement savings wisely

- Manage your retirement income

FAQs about Johnathan Berkery

Johnathan Berkery is a CERTIFIED FINANCIAL PLANNER professional and the founder and CEO of Berkery Wealth Management, a wealth management firm that provides comprehensive financial planning services to individuals and families. He has over 15 years of experience in the financial services industry.

Question 1: What services does Johnathan Berkery provide?

Answer: Johnathan Berkery provides comprehensive financial planning services, including investment management, retirement planning, education planning, and estate planning.

Question 2: Is Johnathan Berkery a fee-only financial advisor?

Answer: Yes, Johnathan Berkery is a fee-only financial advisor. This means that he does not receive any commissions from the sale of financial products. This allows him to provide objective, unbiased advice to his clients.

Question 3: How long has Johnathan Berkery been in the financial services industry?

Answer: Johnathan Berkery has been in the financial services industry for over 15 years.

Question 4: What is Johnathan Berkery's educational background?

Answer: Johnathan Berkery holds a Bachelor of Science degree in Finance from the University of Florida. He is also a CERTIFIED FINANCIAL PLANNER professional.

Question 5: What is Johnathan Berkery's investment philosophy?

Answer: Johnathan Berkery's investment philosophy is based on the principles of diversification and asset allocation. He believes in investing in a mix of stocks, bonds, and cash to reduce risk and maximize return.

Question 6: How can I contact Johnathan Berkery?

Answer: You can contact Johnathan Berkery by phone at (561) 228-8040 or by email at johnathan@berkerywealth.com.

Summary: Johnathan Berkery is a CERTIFIED FINANCIAL PLANNER professional with over 15 years of experience in the financial services industry. He provides comprehensive financial planning services, including investment management, retirement planning, education planning, and estate planning. Johnathan Berkery is a fee-only financial advisor, which means that he does not receive any commissions from the sale of financial products. This allows him to provide objective, unbiased advice to his clients.

Transition to the next article section: Johnathan Berkery is a trusted financial advisor who can help you achieve your financial goals. Contact him today to schedule a consultation.

Financial Planning Tips from Johnathan Berkery

Johnathan Berkery is a CERTIFIED FINANCIAL PLANNER professional and the founder and CEO of Berkery Wealth Management, a wealth management firm that provides comprehensive financial planning services to individuals and families. He has over 15 years of experience in the financial services industry.

Here are five financial planning tips from Johnathan Berkery:

Tip 1: Start saving early. The sooner you start saving for retirement, the more time your money has to grow. Even if you can only save a small amount each month, it will add up over time.

Tip 2: Invest for the long term. Don't try to time the market. Instead, invest for the long term and ride out the ups and downs. Over time, the stock market has always trended upwards.

Tip 3: Diversify your investments. Don't put all your eggs in one basket. Instead, diversify your investments across different asset classes, such as stocks, bonds, and real estate.

Tip 4: Rebalance your portfolio regularly. As your investments grow, it's important to rebalance your portfolio to ensure that it still meets your risk tolerance and investment goals.

Tip 5: Get professional advice. If you're not comfortable managing your own investments, consider working with a financial advisor. A financial advisor can help you develop a financial plan and make investment decisions that are right for you.

Summary: Financial planning is an important part of securing your financial future. By following these tips from Johnathan Berkery, you can make sure that you are on track to achieve your financial goals.

Transition to the article's conclusion: Johnathan Berkery is a trusted financial advisor who can help you achieve your financial goals. Contact him today to schedule a consultation.

Conclusion

Johnathan Berkery is a CERTIFIED FINANCIAL PLANNER professional with over 15 years of experience in the financial services industry. He is the founder and CEO of Berkery Wealth Management, a wealth management firm that provides comprehensive financial planning services to individuals and families.

Johnathan Berkery is a trusted financial advisor who can help you achieve your financial goals. He can provide you with objective, unbiased advice on all aspects of financial planning, including investment management, retirement planning, education planning, and estate planning. Contact him today to schedule a consultation.

Jonathan Berkery, syn Toma Jonesa, jest bezdomny. Mieszka w schronisku

Who's the Daddy? Mirror Online